So you've decided to take the plunge into the exciting world of business. Starting a new business is one of the most satisfying ventures to undertake as you'll be working for yourself and watching your efforts bear fruit. You need to set up your business in the right way to ensure your enterprise runs smoothly without any hiccups.

Initial Setting Up of Your Business

The first thing that you have to do is decide on what sort of business structure you're going to need for your particular service. Perhaps you're a plumber and want to start a plumbing service business as a sole proprietor. That means that you're starting your business as an individual who's trading on their own. Now you've got to choose a name for your business. You may want to select a name like 'Payne Plumbers' to better identify the type of business you're conducting.

Once you've decided on the name for your business, the next step is to apply for and register your business name with the relevant authorities. In Australia, you have to register your business name in the Australian state or territory in which you plan to operate. Before you can register your chosen business name, you must first check to see if the name is already registered as a business. If it hasn't, then you can go ahead and register your business with the relevant State Consumer Affairs Department.

Next, you have to apply for an Australian Business Number or ABN. This is a unique 11 digit number which is exclusive to your business. You'll use this number when transacting with other businesses or customers. It's important to include your ABN on your sales invoice otherwise your debtors have the right to withhold 46.5% of any payment due to you. It's necessary to have an ABN to facilitate communication and dealings with the Australian Taxation Office or ATO.

Another important reason why you'll need the ABN is because it's necessary to register your business for Goods and Services Tax or GST. You now have to register for GST to ensure that you can both charge and claim GST credits on your sales and purchase invoices. It's vital that all your invoices to customers include a 10% charge for GST. You'll also be charged GST on any supplies that you purchase. You must account for the difference between the GST paid by your customers and the GST you've suffered on your supplier invoices, to the ATO every quarter.

Sorting Out Your Business Accounts

This critical component of a new business start up cannot be stressed enough. Setting up your accounting system is vital if you are to get a good grip on the financial aspects of your business. You need to have a chart of accounts to classify the various accounts in your business in order to charge expenses and allocate payments. You must have monthly bank reconciliations performed to find out your true cash balances and what cheques have not cleared in the bank statement. You also need to reconcile your credit card accounts if you're using your credit card for business purposes. You need to have proper debtor management systems in place so that you know the extent of your Accounts Receivable.

At the end of every month, you should be able to assess how well your business is doing from the monthly management accounts. You can determine how much income your business has made and how much you owe your suppliers. You'll see your various accounts in a trial balance that ensures all the debits and credits are in balance.

All these functions are important for the smooth and efficient running of your business. You should use the services of an excellent bookkeeper to ensure that your accounting records are maintained systematically, accurately and completely.

Connecting with an MYOB Partner

The most common business accounting software in use in Australia is MYOB or Mind Your Own Business. You should team up with an MYOB Approved Partner to ensure your business accounting requirements are efficiently handled. A MYOB Approved Partner will utilize this cost effective, powerful and competent software to manage your entire accounting records from the Accounts Receivable and Payable to Invoicing and BAS.

The benefits to your business are multifarious as you'll be assured that only state of the art and comprehensive accounting software is being used to record your transactions, update your accounts and invoice your customers. You can have access to timely support for MYOB services and be apprised of the latest software updates that further enhance performance.

Getting Your Business Off To A Good Start

As a new business owner, you're most concerned about getting new clients and building your business. You're focused on providing excellent services to your customers and retaining their custom. You're driven and primed for quality output. You're also often pressed for time with many activities and tasks demanding your attention at once.

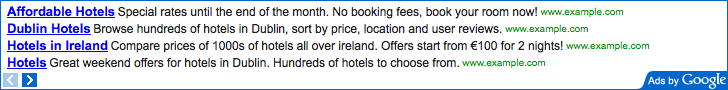

Furthermore you need to have an online presence to add credibility to your business. Many people search for services on the internet and are often impressed if you have a website they can refer to for further information. You must have a registered domain name and have your website designed attractively to garner more traffic and optimized for better sales conversion. Your site has to be hosted on a reliable server to ensure you're available on the Net 24/7 with no downtime or broken links. You must be able to communicate with your suppliers and clients via email, a fast and efficient mode of communication.

Bookkeeping Central can provide you with all these primary services through their affordable and value for money new business starter packs. You'll get the entire package from business name registration to having a website for an online presence. Your books will be carefully and meticulously looked after by this Australian accounting services so that you can focus on growing your business. Get your new business off to a great start with Bookkeeping Central